OUR 9TH YEAR OF PROVIDING PROPRIETARY CAPITAL MARKETS INTELLIGENCE ON THE CANNABIS / HEMP / PSYCHEDELIC SECTORS

Home » Week of 2/20/23-2/24/23

Debt Capital Raises

Debt Transaction Chart

Viridian publishes weekly data and analysis on debt capital raises in the Cannabis/CBD/Psychedelic industries. This data includes information about the company issuing debt (public/private, state/country location), deal size, deal structure, pricing, warrants, and credit data.

Week ended 02/24/2023

Debt Commentary

Week ended 02/24/2023

- Debt accounted for 62% of trailing 4-week capital raises. We expect this ratio to be volatile because of the limited capital raise activity. Debt should average over 50% of capital raised, especially since many companies are trading at or close to their 52-week lows. Since year-end, debt costs have significantly increased because of higher treasury rates and risk spreads. Accordingly, more companies are using equity-linked structures like this week’s Canopy Growth convert and the recent MariMed and Tilt Holdings transactions.

The Week’s Largest Debt Raise:

-

- On February 21, 2023, Canopy Growth (WEED: TSX)(CGC: Nasdaq, the 2nd largest Canadian LP by market cap, cultivation, manufacturing, processing, brand development, and retail, agreed to sell $150M of senior unsecured convertible debentures to an institutional investor. The first $100M was received at closing, with the remaining $50M subject to the satisfaction of certain conditions.

- The notes carry a 5% coupon which will be paid in common shares, as will any principal outstanding at the maturity date of 2/28/2028. In this regard, the notes resemble a forward equity sale since all principal and interest payments will be paid in additional stock shares.

- The debentures are convertible at 92.5% of the three-day VWOL price of the shares ending on the trading day of conversion.

- The 5-year discount conversion option is quite valuable. We value it at approximately 40 points of bond value. Treating this as an OID gives us an effective cost of roughly 17.18%. This transaction is dangerous for shareholders as it resembles an equity line with corresponding downward pressure on the stock price.

- The effective cost is consistent with our view that Canopy is a stressed credit. The Table below shows the rankings of the seven Canadian Cultivation & Retail companies with over $100M market cap. Canopy ranks as the fifth strongest of the seven based on having the worst ranking for liquidity (proforma for this transaction), the worst profitability ranking, and the second worst leverage ranking.

![]()

![]()

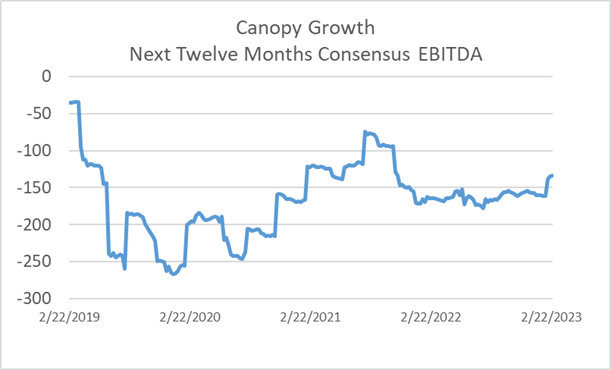

- The graph below shows consensus analyst estimates for the Next Twelve Month EBITDA from February 2019 through February 2023. Canopy missed analysts’ estimates for 9 of the last 16 quarters, including the four most recent.

Week ended 02/24/2023

Additional content is available to Premium and Enterprise users. Please purchase a higher tier membership to see more.

Weekly Credit Tracker

Each week, Viridian highlights a specific industry sector and provides a deep dive into credit metrics and comparable company credit rankings for public companies operating in that sector. Credit ratings are not currently available for public cannabis companies leaving companies, lenders, and investors with a gap of information. The Viridian Cannabis Credit Tracker fills this gap. The model uses 11 market and financial statement variables to discern 4 key credit factors: Liquidity, Leverage, Profitability, and Size, to provide credit/liquidity analysis for over 370 public Cannabis/Hemp companies.

- Week ended 02/24/2023

This week’s credit tracker focuses on the 7 Canadian Cultivation & Retail sector companies with market caps between $50M and $500M in the Viridian Value Tracker database in order to make the case that Auxly had a good reason to sell assets, even at prices significantly below its cost: The firm is over levered and needs to sell assets to reduce debt. The Viridian Credit tracker ranking system shows Auxly near the bottom of the peer group in terms of credit quality.

- Week ended 02/24/2023

This Chart is Only Available to Higher Tier Memberships

Please Purchase a Premium or Enterprise membership to see more.

Additional content is available to Premium and Enterprise users. Please purchase a higher tier membership to see more.

This Chart is Only Available to Higher Tier Memberships

Please Purchase a Premium or Enterprise membership to see more.

Viridian publishes weekly insights on debt capital raises in the Cannabis/CBD/Psychedelic industries. These insights typically highlight the most interesting/meaningful debt transactions of that week, and commentary on market conditions, debt deal structures, and lenders.